By far online payment is the easiest and most efficient way to pay income tax in Malaysia. With effect from YA 2008 where a SME first commences operations in a year of assessment the SME is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment.

Lhdn Tax Payment Codes Ccng Chartered Accountants

Featured PwC Malaysia publications.

. The CP204 form was submitted on Nov 30 2019. In relation to this the Inland Revenue Board IRB has issued the Frequently Asked Questions FAQ - Deferment of Payment of Estimated Tax. The impact of Covid-19 is such that the company now estimates its tax liability to be RM7500.

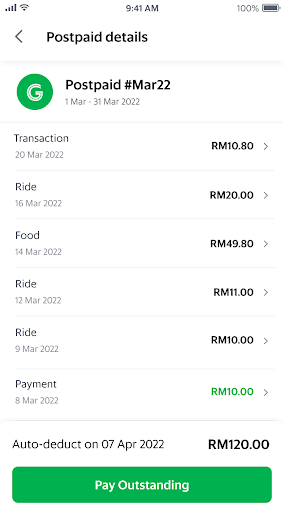

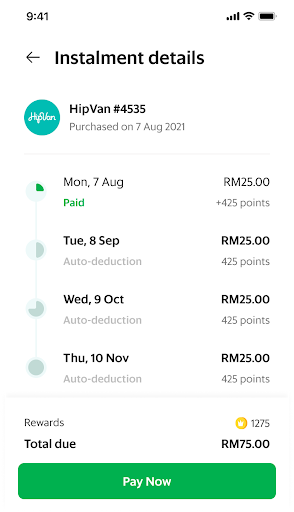

Installment Payment CP204 For existing companies the estimated tax payable has to be paid in equal monthly installments beginning from the second month of the basis period for a year of assessment. However there are downsides to early filing and most people should or cant use the option. The company can submit their request to IRBM Collection Unit in writing before the due date for payment.

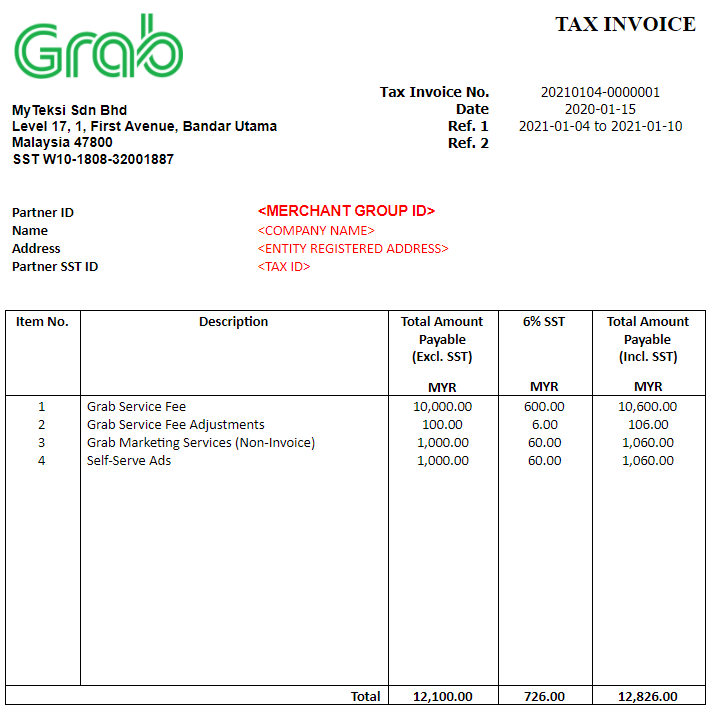

User is required an internet banking account with the FPX associate. Advance corporate tax estimated tax generally is payable in monthly installments in Malaysia and an underestimation of the tax payable may result in penalties under certain circumstances. Melayu Malay 简体中文 Chinese Simplified Estimate of Tax Payable in Malaysia.

6 months or 12 months Interest free Installment. IRBs FAQs on revision of estimate of tax payable and deferment of tax instalment payments arising from COVID-19 measures. Jacks Income Tax Payments RM 100000 x 28 RM 28000.

To be considered for. However even if the request is accepted late payment penalty will still be imposed. The income tax payable account can be found using the keyword method described above.

Tax Payment via Credit Card through ByrHASIL portal will only be available from 1200 am until 1059 pm daily. This page is also available in. These services can be used for all creditdebit cards VISA Mastercard and American Express issued in Malaysia.

Monthly Tax Deduction MTD 6. Tax Leader PwC Malaysia 60 3 2173 1469. The Collection Unit at the LHDN branch where your actual tax file is kept must be notified of your intent to request installment.

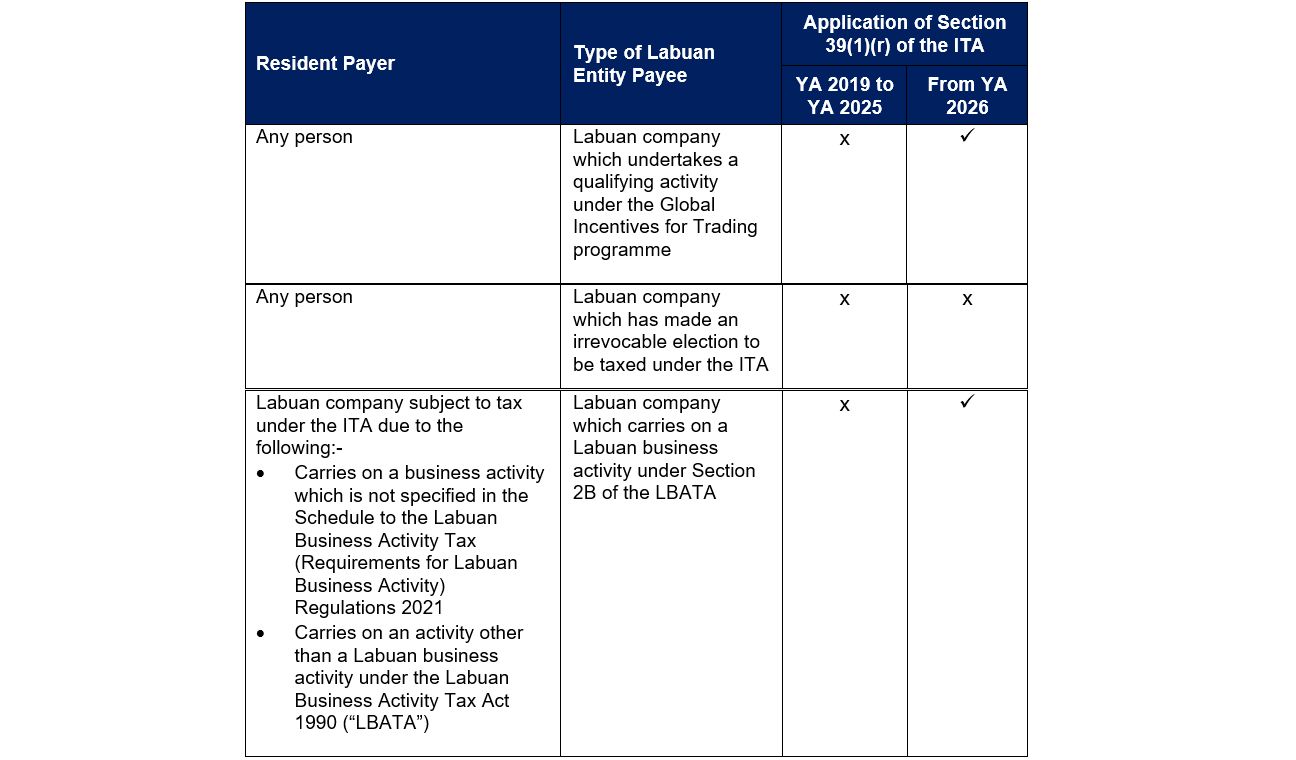

ABC Sdn Bhd has estimated its tax for the year ended Dec 31 2020 to be RM12000. As highlighted in earlier alerts a number of tax and non-tax measures have been announced as Malaysias response to the COVID-19 pandemic including the following. The Malaysian Inland Revenue Boardfollowing announcements in the 2022 budgetissued the following guidance for small and medium-sized enterprises SMEs.

1 Payment via Telegraphic Transfer TTTransfer Interbank Giro IBGElectronic Fund Transfer EFT Tax payment using this method can be made to the Inland Revenue Board of Malaysia IRBM banks account. If you are a farmer or fisher you can avoid the estimated tax payment for the fourth quarter if you file your annual return Form 1040 etc and make your tax payment due by March 1. How Do I Pay Income Tax Online.

Form CP500 LHDN is a tax installment scheme for a taxpayer that has income other than employment income such as business income rental income and royalties. Crystal Chuah Yoke Chin Tax Manager. Total months in the basis period.

Real Property Gain Tax Payment RPGT 5. Pay Taxes Online tab. Form CP500 Payment should be made within 30 days from the date payable Tarikh Kena Bayar.

Twelve instalments of RM1000 each are payable from Feb 15 2020 until Jan 15 2021. Details of the account are as. The IRBs media release and FAQs provide relief by permitting businesses an additional opportunity to revise their tax estimate in the 11th month of the.

Paying taxes online is as easy as logging in to the Tin-NSDl website and clicking on the e-payment. This service enables tax payment through FPX gateway. Keep updated on key thought leadership at PwC.

Guidance FAQs on estimated tax payments for all businesses deferred tax instalments for SMEs. 2514 Ipoh Office. - Income tax expense.

Income Tax Payment excluding instalment scheme 7. Under the PEMERKASA Stimulus Package announced by the Government on 17th March 2021 it was proposed that deferment of tax instalments be granted to companies in the tourism and selected industries eg. Companies are required to pay tax by monthly instalments based on the estimates submitted commencing from the second month of the companys basis period.

2188 Kota Kinabalu Office. Your income tax payment can be made with Ezypay of 6 months 125 interest or 12 months 205 interest if your income tax amount is between RM1000 to RM500000 and you are. Failure to remit the tax installment if any by the filing deadline will result in a 10.

In the payment account section select either checking account if you are paying your taxes right away or income tax payable as the payment account. Hence the amount of total income earned would be your chargeable income which would be used to compute your final income tax payment at a flat rate of 28. Income tax payment can be made by credit card Issued by Malaysia bank in Malaysia.

Tax Installment Form Malaysia. How Do I Pay My Installment Tax In Malaysia. However credit card charges of 080 will be imposed on your income tax payment.

If you are not a tax resident you would not enjoy income tax reliefs. The amount of taxes you owe. If company unable to pay their balance of tax by the due date the company can apply to pay the balance by instalments.

The best would be via the IRBs own online platform ByrHASILIts the only online platform that supports payment by credit cards Visa Mastercard and American Express so you can earn some points or cashback for paying income tax just note that there is a processing. You will need to fill in two expense account lines with.

Maulid Dan Daurah 40 Malam Sandakan Malaysia 2015 2016 Malam

7 Things To Know About Income Tax Payments In Malaysia

Eft Nedir Nasil Yapilir Blog Seyahat Para

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Payment Method For Personal Income Tax Bona Trust Corporation 博纳信托有限公司

Taxplanning Tax Measures Announced During The Mco The Edge Markets

How To Pay Your Income Tax In Malaysia

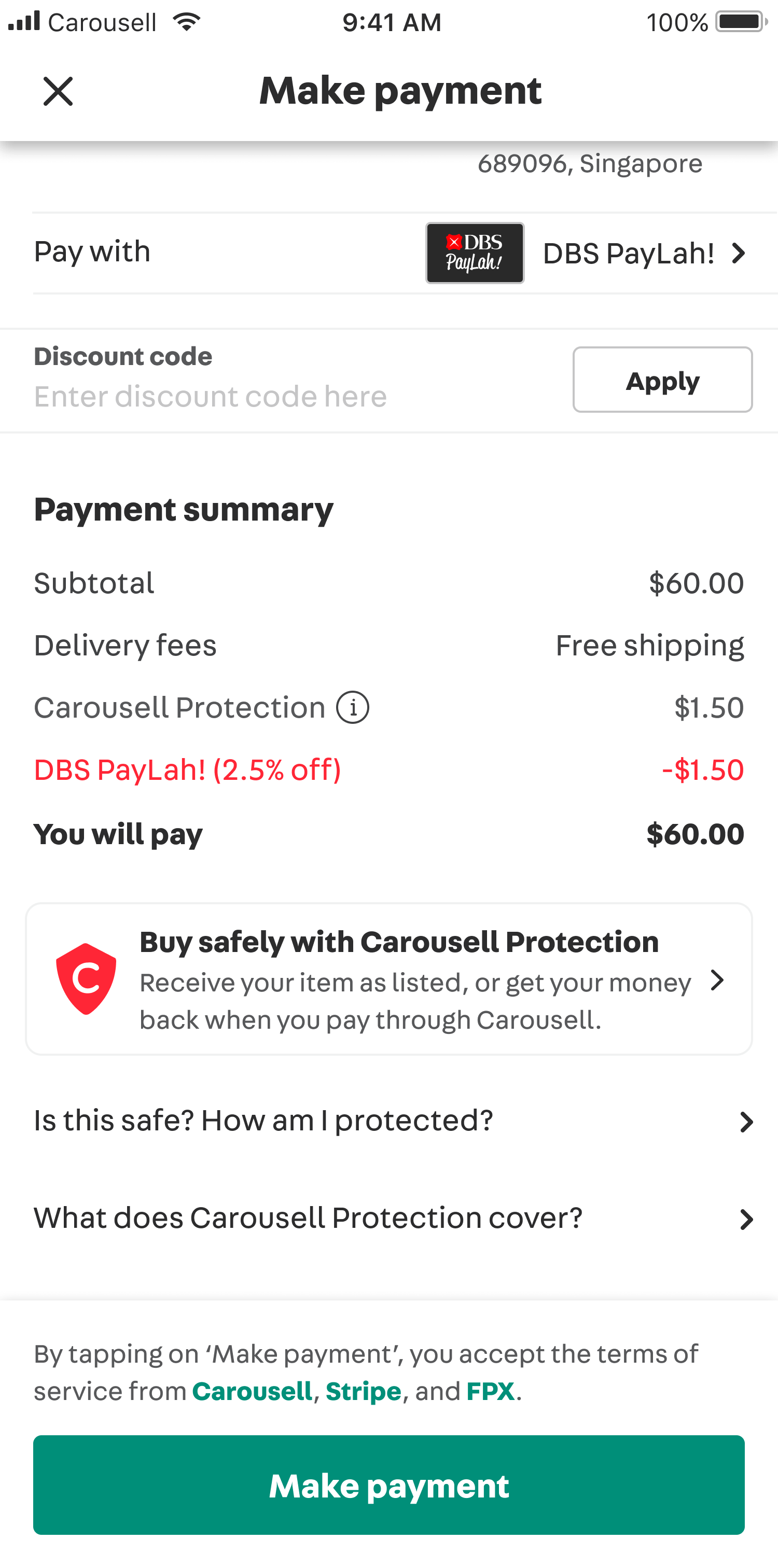

Singapore Fees And Payments Carousell Help Centre

Advance Payment Invoice Template 9 Free Docs Xlsx Pdf Invoice Template Invoicing Advance Payment

Lhdn Allows Automatic Deferment Of Tax Payment For Cp204 Cp500 And Other Selected Industries Dayakdaily

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Public Bank Berhad Lhdn Income Tax And Pcb Payment